The teleco giant Safaricom in conjunction with Kenya Commercial Bank(KCB) and NCBA the Fuliza underwriters have announced a reduction in Fuliza charges by 40%. The new rates will take effect from 1st october.

Fuliza which is one of the three products offered by Safaricom in conjunction with the two banks is their most profitable with their revenues jumping by 31% in the past financial year to register KES 5.94 billion. Other products are M-shwari whose revenues have dipped by 13.4% and KCB M-pesa which also dipped by 18.7%.

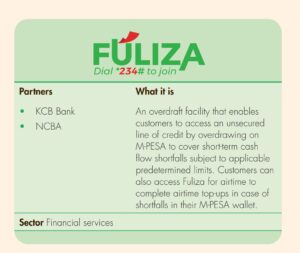

This has come as Fuliza customers were decrying the high interest rates charged on the overdraft service which allows one to transact amounts above their current M-Pesa balances.

The daily maintenance cost will decrease from five percent to three percent for customers who withdraw between Ksh100 and Ksh500, according to a statement from Safaricom dated September 28. In addition, subscribers will now be charged 6% daily interest on overdrafts between Ksh501 and Ksh1,000.

Furthermore, the daily fees for borrowers of loans between Ksh 1,001 and Ksh 1,500, Ksh 1,501 and Ksh 2,000, and Ksh 2,501 and Ksh 70,000 have been reduced by 10, 20, and 16.7 percent, respectively.

However, these new discounts will only be available to those customers with no outstanding debt balances. Customers will therefore have to clear their debts before they are incorporated into the new regime

Leave a Reply